Managing and keeping track of billing is a daunting task when we use a plain Excel worksheet. Using an Excel Invoice Tracker can ease this task. An Invoice Tracker helps a business entity pay bills on time and indicates bills that need follow-up. An Invoice Tracker Template is the best way to maintain such billings and run an organization efficiently.

Invoice: A document that holds a detailed, priced, and itemized description of each product and service provided by a business entity to customers. Business entities use invoices for billing purposes. In aspects such as Accounting, Tracking Sales, and Inventory, invoices are essential. Invoices keep track of any billing a business entity makes and how much revenue is earned or due is owed. The format of an invoice is up to the users. A user can use a simple format or customize it as his business demands. Some key fundamental elements in an invoice have to be included: company and Customer Contact Details, Invoice Amount, Amount Due, Invoice and Payment Dates, Outstanding, and Status. Also add an entry you feel necessary according to your invoice type. Invoice Tracker: Making invoices track bills and dues in an Excel worksheet called Invoice Tracker. Businesses have to track their invoices to count revenue and costs. There is numerous software to track invoices but rarely do they support customizations, they are expensive too. One business may need multiple types of invoices which leads to further complications. As a result, the best way to deal with all these shortcomings is to use an Invoice Tracker Template. Download an Invoice Tracker Template and then customize it according to your needs. Most templates are compatible with Microsoft Excel.

Invoice trackers offer the following benefits while working on them. ➤ It tracks all invoices in one worksheet. ➤ Identify due invoices and their latency. ➤ Calculate outstanding amounts. ➤ Calculate expected near-future payments. ➤ Find the amount due to respective customers. ➤ Convenient to use.

Every business is unique in its own way. Therefore, the formats of an invoice differ from business to business. However, the below basic elements should exist in an ideal invoice tracker template. ➤ Invoice Date ➤ Invoice ID ➤ Customer’s Detail ➤ Due Date ➤ Invoice Amount ➤ Amount Paid ➤ Amount Outstanding ➤ Status Typical ledgers track invoices chronologically, you can filter an invoice tracker by column headings such as Invoice ID, Date, Customer Name, etc. It’s fair to say that using an invoice tracker, it’s easy to track invoices in a cost-effective way.

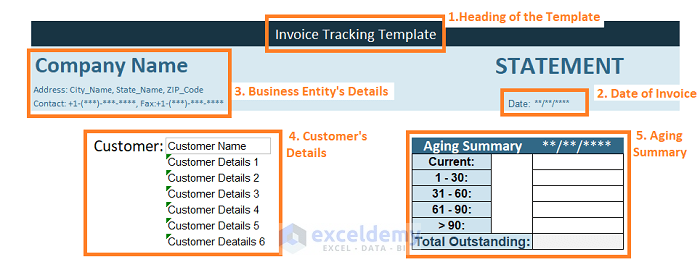

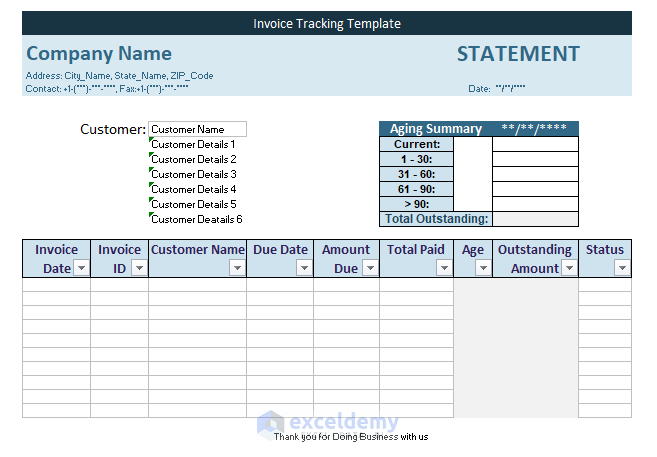

To create an Invoice Tracker Template below elements have to be present in the template. 1. Heading of the Template The invoice tracker must have a heading. It’s because the heading (i.e., Invoice Tracking Template) says what the template is for and why to use it. 2.Date of Invoice The business entity must mention the Date of the Invoice. The invoice date can’t be skipped otherwise it negates all the transactions on other dates. The invoice date should be in the top-most right corner of the template. 3.Business Entity’s Details The details of the Business Entity that provides all the services or goods to any customers, must be entered in an invoice. The top-most left side of an invoice template must contain the business entity’s details such as Business Name, Address, and Contacts. 4.Customer’s Details The details of the customers such as Name, Address, and Contacts must be entered on the left side of the template below the business entity’s details. 5.Aging SummaryAging Summary of a specific customer must be on the right side of the template (i.e., opposite of Customer Details). After all, data inputting, you need to calculate the total outstanding by adding all the aging summary values. Read More:How to Create Fully Automatic Invoice in Excel (with Easy Steps)Similar Readings

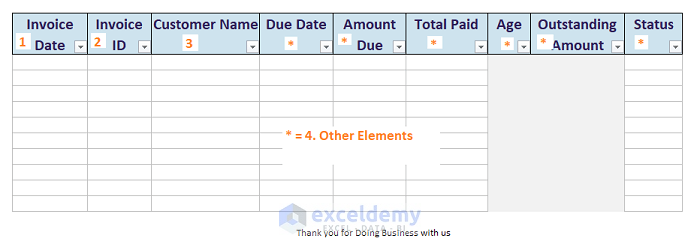

The calculation section contains various subheadings. We discuss the elementary components in the following.

1. Date

Transaction dates must be present in invoices. Dates are a must to calculate the Aging Summary of a particular customer.

2. Invoice ID

After Date, enter Invoice ID. Invoice IDs help to arrange data serially. It’s easy to track any customer with just an invoice ID.

3. Customer Name

Customer details exist below the business entity’s details. However, you need to enter the Customer Name in the adjacent cell of the invoice ID. There are some benefits of inserting customer names in the invoice tracker.

a. Entering customer names is crucial because an invoice is created by incorporating all the details of different types of customers. Naming makes it easy to track.

b. If customer names are duly entered, then it’s simple to track any defaulter and deal with them.

c. We can halt or maintain exclusive services depending on credit scores by simply looking at the invoice tracker by name.

4. Other Elements

Due Date, Amount Due, Total Paid, Age, Outstanding Amount, and Status are some other elements that should be present in an ideal invoice tracker.

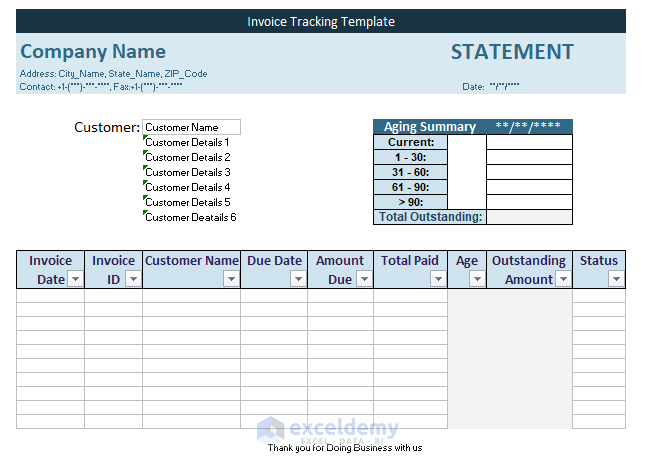

If we combine the information and calculation sections, we get a whole format similar to the following image.

You can follow the below steps to use an Invoice Tracker Template:

⏩ A user has to enter the details as required in the fields depending on his demand.

⏩ User must enter Heading, Invoice Date and Details of Business Owner and Customer in their respective sections.

⏩ The template will start to learn as the user assigns various details. In the calculation section, values should be entered cells according to the column headings.

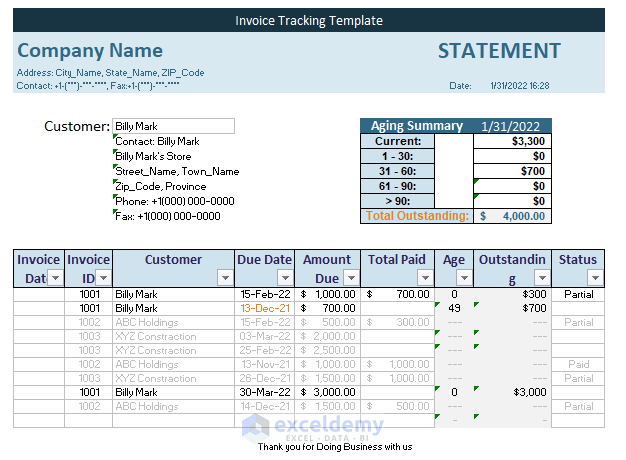

⏩ After finishing all the inputs, various elements such as Aging summary, Outstanding amount, Amount Due, and Age will be calculated automatically as shown in the following screenshot.

Customizing Invoice Tracker: You can customize the downloaded template in the way you want.

Sending Invoice Template: In the case of sending invoices to customers, filter the template with just a particular customer name, export it.

Filtering: You can filter entries in the calculation section by any column you desire.

Formula in Places: There are formulas in Age, Amount Due, Aging Summary, and Outstanding Amount, don’t delete them. Deleting them will harm the purpose of the template.